A A Regulation A+ offer is a type of financing that allows companies to raise capital from the public. This offering is regulated by the Securities and Exchange Commission (SEC) under The JOBS Act, which was enacted in 2012 as part of the Jumpstart Our Business Startups (JOBS) Act.

Unlike a traditional IPO, Regulation A+ offers are more attainable to smaller companies and involve less complex regulatory requirements. This makes it a popular option for startups and businesses seeking funding for growth and expansion.

- WRH+Co provides expert guidance to companies navigating the Regulation A+ offering process.

- We offer a comprehensive range of services, including legal counsel, disclosure document preparation, and marketing support.

Reach out to us| to learn more about how a Regulation A+ offering can help your business reach its full potential.

Regulation A+ Offering: Hype or Reality?

The capital raising landscape is shifting at a rapid pace, with new opportunities constantly emerging. One such trend that has grabbed the focus of both investors and companies is Regulation A+, a type of crowdfunding investment that allows private companies to raise capital from a broader pool of investors.

- But is Regulation A+ all hype or does it truly offer a viable option for both companies seeking funding and investors looking for new investment avenues?

- This article explores the mechanics of Regulation A+ offerings, its potential benefits and drawbacks, and what it means for the future of crowdfunding.

By evaluating the nuances of this layered regulatory framework, we aim to provide a clear and in-depth picture of Regulation A+ offerings, helping investors and companies make informed decisions.

Concisely Explain Title IV Regulation A+ for Me | Manhattan Street Capital

Manhattan Street Capital offers thorough guidance on Title IV Regulation A+, a funding mechanism that empowers companies to raise capital from the public. This framework allows businesses to offer their securities to a broader range of investors, unlocking new opportunities for growth and expansion. Manhattan Street Capital's team provides valuable information to help companies navigate the complexities of Regulation A+, ensuring a smooth and successful fundraising process.

Their services encompass all aspects support, from initial consultation and due diligence to marketing and investor relations. By leveraging Manhattan Street Capital's expertise, companies can effectively leverage the power of Regulation A+ to fuel their aspirations.

The Newest Reg A+ Solution

Companies currently are seeking innovative ways to raise capital. The Reg A+ offering has emerged as a compelling option for businesses of all sizes. With its ability to access a wider pool of investors, this approach provides significant opportunities for growth.

A new Reg A+ solution has recently been developed, offering enterprises a streamlined and streamlined process for conducting successful offerings. This innovation simplifies the entire process, allowing companies to raise capital more rapidly. The benefits of this new solution are numerous, including increased visibility, access to a broader investor base, and reduced costs.

- Additionally, the new Reg A+ platform provides robust regulatory compliance, ensuring that businesses operate within a safe and legitimate environment.

- Therefore, companies are embracing this new Reg A+ methodology to secure the funding they need to succeed.

What's A Reg - Got 'Em All

Listen up, crew. You wanna know about regs? Well, you've come to the perfect place! We got more rules than you can shake a stick at. If you need something official, we've got your back.

We got a wide selection of regs, from the typical ones to the specific. So don't waste your time looking around, come on down and see what we have.

- Trust us

- Regs are our thing

- Drop by

Navigating Regulation A+ in Startups

Regulation A+, a unique funding pathway for startups, presents several opportunities and challenges. Businesses looking to raise capital through this method should thoroughly consider the regulatory guidelines.

- Successful Regulation A+ offerings require a detailed understanding of securities law and legislative processes.

- Seeking expert advice from legal and financial professionals is critical for navigating the complexities of this funding route.

- Transparency is paramount in Regulation A+ offerings. Startups must accurately communicate material information to potential financiers.

By adopting best practices and obtaining expert support, startups can maximize the benefits of Regulation A+ for continuous growth.

Offering Circular Works with Equity Crowdfunding

Equity crowdfunding provides a unique opportunity for companies to raise capital from the general public. When paired with Regulation A+, this fundraising method can unlock significant advantages for both entrepreneurs and supporters looking to invest in promising ventures.

Through Regulation A+, companies can sell their securities to a wider audience of investors, including the general public, without the rigorous regulations associated with traditional IPOs. This streamlined process allows for increased accessibility and transparency in the fundraising journey.

,Moreover, Regulation A+ provides certain protections for investors, such as the requirement for companies to file a detailed offering circular with the Securities and Exchange Commission (SEC). This report outlines the company's business plan, financial status, risks involved, and other relevant information, empowering investors to make more informed decisions.

Therefore, Regulation A+ has emerged as a powerful tool for equity crowdfunding, connecting the gap between companies seeking capital and investors eager to support innovative ventures.

FundAthena's Regulation A+ Funding

FundAthena is leveraging a Regulation A+ offering to attract capital from the crowd. This strategy allows FundAthena to {access{ a broader spectrum of investors while staying compliant securities regulations. The Regulation A+ structure provides advantages for both FundAthena and its potential contributors.

- Advantages of investing

- Significant growth potential

- Diversification

A Clean Slate

Taking a Risk with a blank check can be both thrilling. It unveils the potential for significant rewards, but it also carries an element of uncertainty. Before jumping into this daunting territory, it's crucial to carefully consider the ramifications and set clear guidelines.

- Investigation is Essential

- Mitigation Plans

- Transparency and Communication

Historic Stock Securities

The birth of provincial stock securities in the 17th century marked a pivotal moment in the progress of financial markets. These early instruments symbolized ownership in authorized companies, often involved in business. Investors pursued the opportunity of returns from these ventures, fueling the expansion of colonial economies. Notable examples include the East India Company, which issued stock to support their endeavors. While governed differently than modern markets, these early stock securities laid the base for the complex financial systems we know today.

We Discovered A Reg

It all started yesterday/last week/a few days ago. We were just hanging out/doing some research/looking for clues when we stumbled upon/came across/found something really strange. It was a message/code/recording hidden in plain sight/view/reach. After some time/a lot of effort/just a few minutes, we figured it out! Turns out, it's a Reg - a secret code. We don't know much about it yet, but we're pretty excited/scared/curious to learn more.

- Perhaps it holds the key to a mystery.

Discover Title IV Reg A+ - Crowdfunder Blog

Are you a startup targeting to raise capital in a booming market? Title IV Reg A+ could be the perfect approach for your enterprise. This cutting-edge funding method allows you to access capital from a broad range of investors, including the public.

Our latest infographic provides a detailed overview of Title IV Reg A+, showcasing its key benefits. Learn about the steps involved, the potential it offers, and how it can help your firm reach new levels.

Explore our blog today to receive valuable information about Title IV Reg A+ and how it can impact your fundraising quest.

Regulation A+ Offerings

Securex Filings LLC focuses in assisting companies with their complex Regulation A+ submissions. Our team of seasoned securities lawyers provides thorough legal counsel throughout the entire cycle, from {initialstructuring to definitive filing with the Securities and Exchange Commission (SEC). We recognize the unique needs of companies pursuing capital through Regulation A+, and we are resolved to supporting them achieve their aspirations.

- The company's offerings include:

- Composing registration statements and other regulatory filings

- Executing due diligence reviews

- Advising on compliance

- Formulating marketing materials and investor outreach strategies

Capital Campaign Site

Crowdfund.co is a dynamic platform that connects businesses with potential backers. Whether you're launching a dream, Crowdfund.co offers a powerful resource to attract the capital you require. With its efficient process, Crowdfund.co makes raising capital a accessible experience for all.

- Explore a wide range of inspiring projects across multiple industries.

- Contribute to the causes and creators that resonate you.

- Join a vibrant community of passionate individuals.

The Fundrise Reg A Offering

Fundrise is a well-established website that specializes in providing investors with access to alternative investments. Their equity crowdfunding campaign allows individual investors to invest in carefully selected real estate projects across the United States. This fundraising initiative provides a unique opportunity for individuals to diversify their portfolios by investing in tangible assets that can generate passive income.

- Benefits of Investing: Access to a diversified portfolio of real estate investments

- The possibility of significant financial gains:

- Lower investment minimums than traditional real estate:

A Securities and Exchange Commission

The Stock and Exchange Commission serves as a federal agency of the United States government. Its primary function is to preserving investors, promoting fair operations, and upholding securities standards. The SEC monitors the activities of publicly traded companies and other entities involved in the financial markets.

Moreover, the Commission conducts investigations to detect and address unlawful activities within the market. Via its regulatory authority, the SEC strives to maintain a transparent and stable securities environment.

Obtaining Funding Via CrowdExpert Title IV Reg A+ Equity Crowdfunding

CrowdExpert's Title IV Regulation A+ equity crowdfunding platform provides companies with a effective avenue to generate capital from the wider market. This regulatory framework allows entities to raise significant amounts of finance while meeting regulatory requirements. By leveraging CrowdExpert's experience, founders can understand the crowdfunding process and interact with a diverse pool of potential investors.

Furthermore, CrowdExpert provides guidance throughout the entire campaign, from document preparation to marketing strategies. This holistic approach ensures a successful crowdfunding experience for contributors alike.

Testing the Waters Crowdfunding for Masses

Crowdfunding has transformed the fundraising landscape, offering a revolutionary platform for individuals and organizations to secure capital. Nonetheless, launching a successful crowdfunding campaign requires meticulous planning and execution. Testing the waters before diving headfirst into a full-scale campaign can highlight invaluable in gauging public reception. A small-scale test run allows creators to fine-tune their pitch, analyze target audience preferences, and reduce potential risks.

- By performing a pilot campaign on a limited scale, creators can collect valuable feedback and insights about their project's appeal.

- Moreover, testing the waters allows for experimentation with different promotional approaches.

- It provides an opportunity to discover potential obstacles and create solutions before a full-scale launch.

Finally, testing the waters with crowdfunding facilitates creators to make intelligent decisions, increasing the likelihood of a successful and impactful campaign.

FundingSolution

StreetShares is a leading platform dedicated to providing small business products to companies. Founded in 2018, the company focuses on matching lenders with startups seeking funding. StreetShares utilizes a innovative approach to evaluating risk and accelerating the credit process.

- StreetShares' core goal is to facilitate small businesses by providing them access to funds.

- Furthermore, StreetShares contributes to create a equitable landscape.

Effective Fundraising Using Regulation A+

Regulation A+, a novel fundraising strategy, has emerged as a viable option for companies seeking to raise capital. This legal framework allows businesses to publicly offer their securities to the overall public, promoting substantial investment. By utilizing Regulation A+, companies can leverage a diverse pool of investors, thus increasing their monetary capabilities.

- Successful Regulation A+ campaigns often utilize a integrated approach that incorporates meticulous planning, targeted marketing efforts, and robust investor engagement.

- Transparency is paramount in Regulation A+ fundraising. Companies must reveal detailed information about their structure, health, and goals to foster investor trust.

- Compliance with standards is critical for a profitable Regulation A+ offering. Companies must engage with legal and financial experts to ensure conformance throughout the journey.

The SEC's EquityNet

SEC EquityNet serves as a tool for investors to connect in the investment landscape. This service, operated by the Securities and Exchange Commission (SEC), aims to facilitate the process of raising capital through equity offerings. EquityNet provides a centralized marketplace where investors can access opportunities for growth.

- Benefits of SEC EquityNet include:

- Capital matching

- Access to investors

- Regulatory compliance

By empowering technology, SEC EquityNet seeks to increase transparency in the equity financing process.

Rule A+ Offerings

Regulation A+ is a set of regulations established by the Securities and Exchange Commission (SEC) to enable fundraising for smaller companies. This system allows businesses to raise capital from a broader range of investors than traditional methods, by offering shares publicly with less stringent reporting needs. A+ initiatives are subject to certain limitations on the amount of capital that can be raised and the type of investors who can participate, but they offer a more straightforward path to public funding compared to conventional methods.

Supervision A+ Companies

Premium companies often face unique regulatory expectations. These stringent guidelines aim to ensure the financial stability and accountability of these entities. Adherence with this framework is vital for maintaining a healthy reputation, fostering public trust, and minimizing potential risks.

- Additionally, A+ companies often enthusiastically engage with regulators to influence the development of regulatory standards.

- They may contribute to industry working groups and promote for amendments that favor the overall market.

Therefore, effective governance practices are essential to A+ companies' performance.

Regulating A+ Summary

A summary of rules is vital for comprehending the extent of a specific policy. A+ summaries go further than simple descriptions, offering evaluation and pointing out key effects. They provide invaluable insights into how legislation will influence various stakeholders, facilitating informed decision-making.

- Additionally, A+ summaries often include charts to demonstrate complex ideas.

- In conclusion, a well-crafted A+ summary serves as a powerful tool for communicating the fundamental of regulatory systems

Regulation A+ Real Estate Networks

The dynamic world of real estate has seen a surge in innovative Marketplaces offering streamlined Transactions . To ensure these ventures operate ethically and transparently, Standards are crucial. Robust Oversight is essential to safeguard consumer Rights and promote market Stability. These Structures can Tackle key concerns like Accountability , Deception, and the protection of Novice investors.

- Implementing clear Protocols is paramount to fostering a Healthy real estate Ecosystem .

- Dialogue between regulators, industry stakeholders, and consumer Advocates is vital to developing effective Approaches.

Our Startup's IPO via JOBS Act and Reg A+ on OTCQX is a Reality

It's officially/finally/here happening! After months of preparation/hard work/determination, my company, FutureTech, is now publicly traded via Reg A+ on the OTCQX. This wouldn't have been possible without the JOBS Act, which has provided a unique opportunity/avenue/pathway for startups like mine to access public/retail/institutional capital and grow/expand/scale. The team is incredibly excited/proud/humbled about this milestone, and we're looking forward to sharing/creating/building value for our investors/shareholders/supporters.

This journey/process/experience has been truly transformative/inspiring/rewarding, and I'm grateful/thankful/appreciative to everyone who has supported/believed in/helped us along the way.

Funder's Club enables Reg A+ offerings on the platform.

FundersClub has recently rolled out a new feature that allows companies to conduct Reg A+ capital raises directly on its platform. This move opens up a wider range of funding opportunities for startups and growing businesses. Previously, companies seeking to raise capital through Reg A+ were often required to engage specialized firms. Now, FundersClub provides a streamlined solution for both issuers and investors.

The integration of Reg A+ equity offerings into the FundersClub platform is expected to accelerate the number of companies that can access this form of capital. Reg A+ presents a unique opportunity for companies to raise capital from a larger pool of investors, featuring accredited and non-accredited investors.

An Overview of Reg A+

Regulation A+, also known as Reg A+, constitutes a financing framework within the United States that allows companies to raise capital from the public. Established by the U.S. Securities and Exchange Commission (SEC), Reg A+ aims to provide a simplified pathway for smaller businesses to access public funding. It offers two of exemptions, allowing companies to raise up to $75 million or $75mil . Reg A+ filings are made with the SEC and require less stringent reporting requirements compared to other securities offerings.

- Key Benefits of this regulation include its ability to raise capital with speed, broaden ownership, and enhance public visibility for companies.

Scrutinizing A+ Crowdfunding Platforms

The booming landscape of crowdfunding has witnessed the growth of platforms dedicated to funding innovative ventures. These A+ platforms often solicit ventures with a high degree of promise for success. However, the lack of robust oversight can pose risks to both contributors and project creators.

Creating clear regulatory standards is vital to ensuring the transparency of A+ crowdfunding platforms. Authorities must endeavor to achieve a administrative environment that promotes innovation while shielding backers from potential deception. Robust regulations can help to foster a more honest and credible crowdfunding ecosystem.

Legislation A+ IPO

The path of an A+ IPO involves rigorous requirements. These policies are in place to protect market transparency and investor trust . Governing bodies play a crucial role in overseeing the IPO cycle , executing thorough reviews of companies seeking to go public. This meticulous examination helps to mitigate uncertainties and encourage a thriving capital market.

Offering Regulation A+ Guidelines

Regulation A+ offers a unique avenue for companies to raise capital by selling securities to the public. However, navigating this complex regulatory landscape can be challenging. Understanding the comprehensive specifications of Regulation A+ is crucial for successful submissions. Entities must adhere to stringent reporting expectations to ensure compliance and protect investor rights. The Securities and Exchange Commission (SEC) provides detailed guidance on the various aspects of Regulation A+, including eligibility conditions, offering materials, and ongoing maintenance. It's strongly recommended that companies seeking to utilize Regulation A+ consult with experienced securities attorneys and financial advisors to ensure a smooth and successful journey.

Guidelines A+

Achieving Compliance with Regulation A+ can be a Demanding process. It involves Grasping the intricate Elements of the Structure. Entities must Implement robust Systems to ensure they are Satisfying all Obligations.

- Essential aspects of Regulation A+ include Record Security, Visibility, and Responsibility.

- Meaningful Execution requires a Comprehensive approach that Covers all Areas of the Regulation.

Continuing abreast of Amendments to Regulation A+ is Essential for Ensuring Accomplishment.

Regulations for Offering

When presenting a new solution, it's crucial to be mindful of the relevant standards. These guidelines help ensure equity in the market and protect both customers. Depending on the type of your product, you may need to meet specific regulations. This can involve registering your business, presenting required documentation, and satisfying certain specifications. Understanding these regulations is essential to debuting a successful product in the market.

Exploring Regulation in Crowdfunding

Crowdfunding has emerged as a powerful tool for individuals and businesses to raise capital. However, the popularity of crowdfunding has also brought increased scrutiny from regulators worldwide. Governments are continuously working to establish clear guidelines to ensure that crowdfunding platforms operate transparently and protect investors from existing risks. These regulations often involve requirements for platform operators, such as identity verification, reporting requirements for projects seeking funding, and safeguards to mitigate unscrupulous activities.

- Policy makers are striving for a balance between encouraging innovation in the crowdfunding space and ensuring investor funds.

- Evolving regulations often cover issues such as campaignassessment, platformresponsibility, and investoreducation.

- Staying informed on the latest regulatory developments is crucial for both crowdfunding platforms and individuals investing in these campaigns.

Securities Act of 1933 regulations a Jobs Act Section 106 Reg A Tier 2 Offering Regulation A text Regulation A+ offering the Reg A+

The intricacies of fundraising in the modern era often involve navigating a complex web of regulations. One such area attracting significant attention is the realm of digital marketplaces, particularly SlideShare, within the context of securities law. The Securities Act of 1933 and its subsequent amendments, including the Jobs Act Section 106 Reg A Tier 2 offering provisions, have sought to provide a regulatory structure for companies seeking capital through offerings regulated under Regulation A+.

Regulation A+, often referred to as "Reg A+" or the "Regulation A Plus" framework, provides a pathway for companies to raise capital from the public in a more streamlined manner compared to traditional securities offerings. Tier 2 offerings under Regulation A+ allow for higher funding thresholds than Tier 1 offerings, opening up possibilities for startups to access a broader pool of funding sources.

SlideShare's role in this evolving landscape is intriguing. While it primarily functions as a platform for sharing presentations and documents, its potential to facilitate the dissemination of information about Reg A+ offerings raises questions about its legal standing within the securities industry. Further clarity from regulators is needed to articulate SlideShare's permissible role in connection with Reg A+ offerings, ensuring investor protection and maintaining a transparent market for securities transactions.

Reg A vs Reg D

When evaluating a funding plan, businesses often encounter a selection between several key legal frameworks: Regulation A and Regulation D. Both present avenues for collecting capital, but they vary significantly in their requirements. Regulation A, also referred to as Reg A+, is a public offering enabling companies to attract up to $75 million from the investors. In contrast, Regulation D focuses on private placements, where businesses can raise capital from a restricted number of individuals.

- To illustrate, Regulation A requires more transparency to protect investors, while Regulation D offers more flexibility for companies in terms of reporting and compliance.

- Therefore, the selection between these regulations relies on a company's specific needs, aspirations and context.

Rule A concerning the Federal Reserve Bank

FRB Regulation A, also designated as the rule concerning associated entities, is a essential component of the Federal Reserve's structure. It outlines standards for operations of financial institutions and their branches within the national economy. The objective of Regulation A is to guarantee the security and reliability of the banking industry by mitigating potential risks.

- In particular,, Regulation A covers the governance of affiliated entities, including their capitalization, strategies for mitigating financial risk, and conflict of interest.

- {Additionally,{It|This regulation also establishes requirements for disclosure to the Federal Reserve, guaranteeing regulatory oversight of these entities.

Observance with Regulation A is mandatory for all regulated entities that fall under its reach. Violations of the regulation can result in penalties imposed by the Federal Reserve, including fines and limitations on activities.

DPO

A DPO (DPO) is a position within an organization that is responsible for enforcement of data protection laws. They strive for that the organization processes personal data lawfully. The DPO serves as a point of contact for employees regarding data protection issues and partners with other departments to maintain data protection guidelines.

- Some key responsibilities of a DPO include:

- Assessing and evaluating data protection measures within the organization.

- Educating and informing about data protection to staff

- Responding to data subject requests

- Conducting data protection impact assessments

SEC Approves New “Reg A+” Rules for Crowdfunding

The U.S. Securities and Exchange Commission recently/has/officially approved/adopted/implemented new rules under Regulation A+, also known as/referred to/dubbed "Reg A+", to streamline/facilitate/enhance crowdfunding for smaller/emerging/start-up businesses.

These/The/New rules are designed to/intended to/aimed at make it/easier for/allow companies to raise capital/secure funding/attract investments from a wider/broader/larger pool of investors/individuals/backers. The SEC believes/hopes/anticipates that these changes will boost/stimulate/revitalize the crowdfunding industry/sector/market, providing/offering/granting more opportunities/avenues/choices for both companies and potential/aspiring/interested investors.

Specifically/, Notably/, The new rules will/do/permit companies to offer/sell/distribute their securities to a greater/more extensive/larger number of investors/contributors/supporters. They also include/contain/feature clarifications/modifications/updates to the disclosure/reporting/transparency requirements for crowdfunding offerings.

This/These/The new rules are expected to/anticipated to/projected to take effect/become operational/be implemented in the coming/near/forthcoming months, paving/clearing/laying the way for a more robust/thriving/active crowdfunding landscape.

Rules Comparison: Reg A and Reg D

Navigating the intricacies of securities regulations can be complex. Two commonly utilized pathways for raising capital are Reg A+ and Reg D, each presenting distinct characteristics and advantages. Regulation A+, also known as a mini-IPO, allows companies to raise up to $75 million in capital through a public offering process that is less stringent than a website traditional IPO. Conversely, Regulation D provides several exemptions from the registration requirements of the Securities Act of 1933, enabling companies to secure capital privately from accredited investors and limited non-accredited investors.

Rule 506 of Regulation D comprises two main provisions: Rule 506(b) and Rule 506(c). Rule 506(b) permits companies to raise capital from an unrestricted number of accredited investors without a general solicitation. Rule 506(c), often referred to as the "private placement exemption," requires that investors be accredited. Additionally, it restricts general solicitation and advertising in connection with the offering.

- Regulation A+ and Regulation D both provide companies with alternative avenues for raising capital. However, their applicability depends on factors such as the amount of capital sought, the investor pool targeted, and the company's compliance structure.

- Companies considering these regulations should consult with legal counsel to determine the most appropriate pathway for their specific circumstances.

Regulation D Quiz - Rule 506(b) vs. Rule 506(c)

Navigating the intricacies of Regulation D and its provisions, particularly Rules 506(b) and 506(c), is vital for passing your Series 7 exam. Let's delve into these detailed rules and highlight their key distinctions.

- Rule 506(b) permits private placements to an unlimited investors, but with a strict requirement that all purchasers aresophisticated investors.

- Conversely, Rule 506(c) allows for greater adaptability by permitting general solicitation and advertising to potential investors, however, it strictly mandates that all purchasers be vetted investors.

Understanding these distinctions is critical for avoiding non-compliance and ensuring your success on the Series 7 exam.

Leveraging DreamFunded Resources on Regulation A+

Regulation A+, a powerful fundraising tool for enterprises, can be utilized with ease when leveraging the extensive assets offered by DreamFunded. Their platform provides invaluable insights into this regulatory structure, empowering you to comprehend its intricacies and optimize its potential for your project. From comprehensive guides to engaging tutorials, DreamFunded equips you with the knowledge required to successfully launch a Regulation A+ fundraising initiative.

- Explore the specifics of Regulation A+ standards

- Connect with experienced advisors

- Utilize templates for your offering

The Markets

OTC Markets represent a dynamic marketplace for securities that are not listed on major stock exchanges. These markets enable trading in a wide variety of companies, frequently including small-cap and emerging growth firms. Trading on OTC Markets is typically conducted electronically, enabling investors to access these securities easily.

OTC markets often offer increased liquidity for certain securities compared to established exchanges. However, it's vital to conduct thorough due diligence before trading in OTC Markets, as volatility can be more significant due to the characteristics of these markets.

Tripoint FINRA

A intersection point within the nuanced world of securities, a Tripoint FINRA presents uniquechallenges. This notion deals with the interplay between multiple regulatorygroups and specific marketsectors. Understanding these crossroads demands a comprehensive knowledge of regulatory frameworks.

Jumpstart Our Business Startups Jobs act

The Job Creation Act of 2012, commonly known as the JOBS Act, was a revolutionary piece of policy designed to boost small business growth. The act introduced several key provisions aimed at removing the barriers that small businesses face when seeking capital. One of the most notable aspects of the JOBS Act was its expansion of securities laws, allowing for a wider range of investors to participate in start-up company funding rounds.

This change has had a profound impact on the small business scene, providing increased access to capital.

Furthermore, the JOBS Act also aimed to increase transparency in securities, boosting investor trust. The act continues to be evolving as regulators work to maintain the needs of both investors and businesses.

The long-term consequences of the JOBS Act are still unfolding, but it is clear that this policy has had a lasting impact on the landscape of small business investment.

Tycon

A Industry giant, Tycon has reached a significant position within the arena. Their cutting-edge technologies have revolutionized the industry, {gaining{ global recognition for their superiority. Tycon's talented team of professionals is always striving to push the boundaries, ensuring that they stay at the peak.

- Furthermore

- Their company's

- commitment

Achieving SEC Registration

Navigating the regulatory landscape for financial products and services often necessitates complying with the stringent requirements of the Securities and Exchange Commission (SEC). Entities seeking to launch securities or operate within the purview of SEC jurisdiction must undergo a rigorous qualification process. This involves presenting comprehensive documentation, proving financial stability, and adhering to strict regulations. The SEC conducts a thorough assessment of these submissions to guarantee compliance with federal securities laws.

Successful SEC approval is essential for recognition within the financial markets and allows entities to operate permissibly.

The process can be complex and demanding, often requiring expert legal and financial counsel. Moreover, SEC standards are subject to change, necessitating ongoing evaluation and adaptation by entities operating under its purview.

online fundraising sites

Are you passionate about a idea that needs some financial fuel? There are tons of incredible online tools like GoFundMe, Kickstarter, and Indiegogo that can help you secure your funding goals. Each platform has its own features, so it's important to understand which one best suits your needs. GoFundMe is ideal for raising money for everyday struggles. Kickstarter is famous for funding creative projects, while Indiegogo offers a broader range of campaign types and incentives. With the suitable platform, you can bring your vision to life!

Crowdfunding Equity for Biotech Companies

The world of investment is evolving rapidly, with crowdfunding platforms raising the bar for venture capitalists seeking out early-stage companies. From EquityNet to CircleUp, these networks are connecting startups with a global pool of investors. Regulation A+ and Reg D offerings have opened doors for both unaccredited investors to participate in the funding of high-growth industries. Goldman Sachs| Merrill Lynch| Endurance Lending Network are just a few examples of traditional banks venturing into the fintech space, recognizing the immense potential of this evolving landscape.

- Angel List and RocketHub provide avenues for small contributions in software companies.

- SoMoLend focuses on facilitating debt crowdfunding solutions, while MicroVentures specializes in connecting investors with high-potential startups.

- GoFundMe allows for peer-to-peer lending campaigns, supporting a wide range of causes from entrepreneurship to nonprofit organizations.

Online Business Funding, Seed Company and Title III are examples of the many players shaping this dynamic industry. Finra and the SEC are actively working to ensure compliance within the crowdfunding ecosystem, protecting both investors and businesses in this exciting new era of capital formation

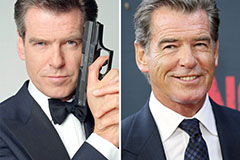

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!